The Daily Observer London Desk: Reporter- Victoria Smith

Inflation remains ‘too high’ and interest rates may need to rise again to bring it back under control, according to the head of the Federal Reserve.

In a highly anticipated speech at the annual Jackson Hole symposium of central bankers in Wyoming, Jerome Powell said the task of taming inflation in the United States is far from over.

And he insisted the Fed will ‘keep at it until the job is done’.

The comments sent the dollar higher on the currency markets and borrowing costs rose on the bond markets as investors digested his seemingly hawkish tone.

Analysts said the speech reinforced the view that interest rates in the US and around the world were likely to stay ‘higher for longer’ – though many still expect the Fed to start cutting rates next year as the economy slows.

A mountain to climb: Jerome Powell said the task of taming inflation in the United States is far from over

‘It is the Fed’s job to bring inflation down to our 2 per cent goal, and we will do so,’ Powell said. ‘Although inflation has moved down from its peak – a welcome development – it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.’

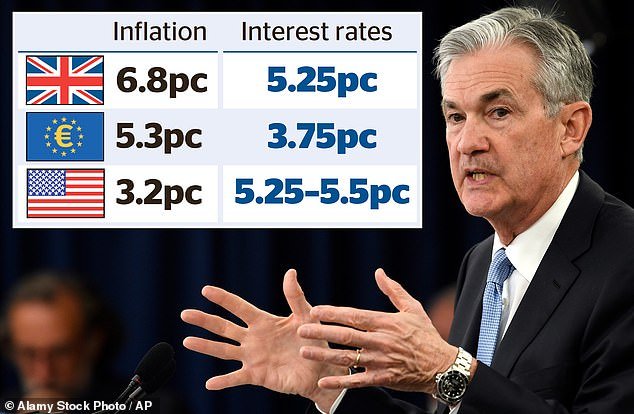

Inflation in the US has fallen to 3.2 per cent from a 40-year high of 9 per cent.

Having raised rates from close to zero to over between 5.25 per cent and 5.5 per cent, Powell said Fed officials would ‘proceed carefully’ as it weighs up further hikes.

At the same time, he suggested the Fed could hold rates steady at its next meeting in September, adding that the decisions would depend on economic data.

‘Given how far we have come, at upcoming meetings we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks,’ he said.

Michael Arone, chief investment strategist at State Street Global Advisors, said: ‘Powell continues to walk a tightrope.

‘I think he is demonstrating that he is pleased with how far monetary policy has come and how inflation has been reduced.

‘But he is still holding on tightly to this notion that they are watching it carefully and they still have work to do.’

Central banks around the world have been raising interest rates in a desperate battle to tame runaway inflation. The Bank of England has raised rates from 0.1 per cent to 5.25 per cent since December 2021 –pushing up the cost of borrowing for millions, including families with mortgages. But inflation remains stubbornly high – down from a peak of 11.1 per cent but still more than three times the 2 per cent target at 6.8 per cent.

The Bank is expected to raise rates again next month to 5.5 per cent.

But with the economy slowing and shock figures this week showing private enterprise in decline, there is a debate raging as to how much further it will go. The European Central Bank is also facing a quandary – particularly given the moribund state of the German economy. Having raised rates from negative territory to 3.75 per cent in just a year, it is thought the ECB could hit the pause button next month and leave benchmark borrowing costs unchanged.

However, despite growing hopes that rates around the world are close to their peak, any meaningful cuts look some way off as the battle against inflation goes on.