The Daily Observer London Desk: Reporter- Victoria Smith

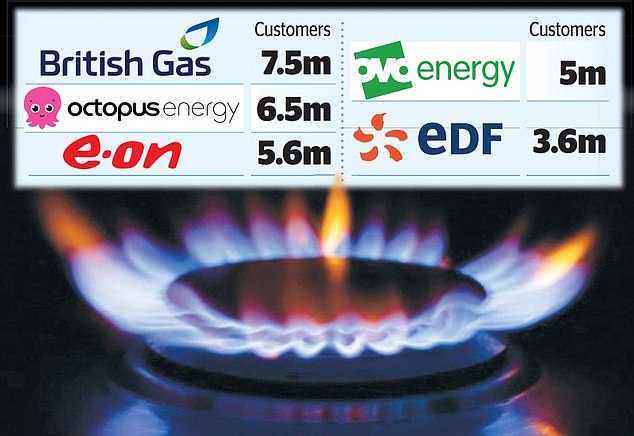

Octopus is set to become the UK’s second biggest energy supplier after it announced plans to buy Shell’s household gas and electricity business.

The company, which started as a challenger to traditional suppliers, has climbed the rankings of the energy firms and now only Centrica-owned British Gas lies ahead of it.

Founded in 2015 by businessman Greg Jackson, Octopus will supply energy to almost 6.5m customers following the deal.

The acquisition, which also includes Shell Energy’s German business, comes less than a year after Octopus took on 1.5m customers from Bulb after its collapse into administration.

The deal needs regulatory approval and is expected to be completed in the fourth quarter of the year.

The Competition and Markets Authority declined to comment on whether it will investigate.

Chief executive Jackson said: ‘Octopus has proven that it delivers game-changing service while innovating and investing relentlessly towards a cheaper cleaner energy system.’

Consolidation in the energy sector has ramped up over the last few years with Octopus emerging as one of the major players.

Many smaller suppliers collapsed in the autumn and winter of 2021 under the pressure of soaring wholesale gas prices, with millions of customers snapped up by surviving businesses. The biggest casualty of the crisis was Bulb, which had been Britain’s seventh biggest energy supplier.

E.On bought N Power in 2019 and Ovo Energy, founded by Northern Irish businessman Stephen Fitzpatrick in 2009, purchased SSE in January 2020.

Ovo Energy’s and Octopus’s trajectories are similar.

Both were founded by British entrepreneurs as challengers to the established suppliers and have gone on to become two of the major players in the UK’s energy market.

Shell Energy entered the UK domestic energy market when it bought First Utility in 2018. The oil giant announced in June that it had put its British and German domestic energy business up for sale, exiting the household energy supply sector after just five years.

It followed a strategic review of the division under chief executive Wael Sawan, who was appointed in January this year.

In May, it was reported that Ovo and Centrica were among those also interested in bidding for the company.

Spreading its tentacles: Octopus was founded in 2015 by Greg Jackson

Shell Energy customers in the UK will be transferred to Octopus following the deal’s completion and will not face any disruption to energy supply.

Shell is also winding down its home energy retail business in the Netherlands but said it does not plan to exit the home energy markets in Australia or the USA. Russ Mould, investment director at AJ Bell, said that the ‘deal suits the strategic objectives of both firms’.

‘Shell exits a market that has seen low returns for energy providers, thanks to soaring wholesale energy costs and increased regulatory and political pressure in the form of caps on the prices that suppliers can charge their customers,’ Mould said.

He added: ‘Providing the transaction gets regulatory approval, this is another step for Octopus to cementing its position as a leading supplier in the UK energy supply market, following the failure or withdrawal of many rivals and its purchase of Bulb in 2022.’

The deal also includes 500,000 UK broadband customers.

Octopus does not currently have a broadband division and said it could not comment on plans for those customers until after the deal receives regulatory approval.

James Mabey, an analyst at analysis provider Cornwall Insight, said: ‘This marks the second major customer book acquisition by Octopus Energy in the last year, after the transfer of Bulb’s customers.

‘The transfer of Shell’s customers will represent an increase in customer numbers on a similar scale. The acquisition will see concentration in the domestic supply market taken to its highest level since early 2016.’

What to do if you’re a Shell Energy customer

The deal is expected to complete in the final three months of 2023 following regulatory approval so Shell customers have been advised to sit tight.

In time they will be transferred to their new account with Octopus, together with their existing direct debits and all customer credit balances are protected.

Natalie Mathie, energy expert at Uswitch, said: ‘Until any takeover is done and dusted, the business will operate as normal.

‘Customers can be reassured that whatever happens, their credit balances will be protected and no action is required from them.

‘Shell Energy’s decision to exit the market is disappointing, as it has been a well-backed challenger to the larger energy suppliers.

‘It is important that there is strong competition between firms in the longer term, so suppliers cannot rest on their laurels when it comes to service quality and price.’